401k calculator with over 50 catch up

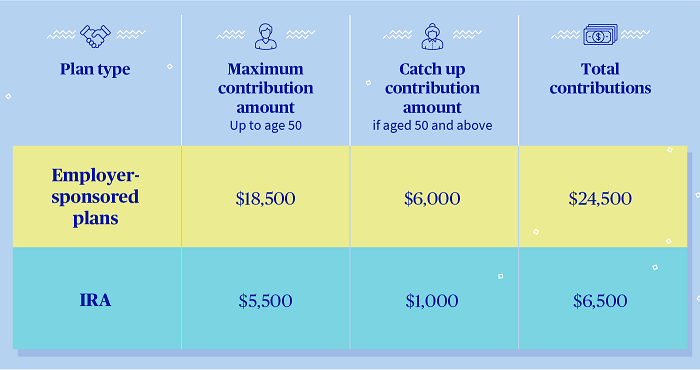

However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to 27000. You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit.

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

The Best Retirement Plans To Build Your Nest Egg

Ad Compare 2022s Best Gold IRAs from Top Providers.

. The Internal Revenue Service allows individuals who are age 50 or older by the end of the calendar year to make extra pre-tax contributions to their work-sponsored retirement. Participants who are 49 and younger may save 20500 but those over 50 are allowed an additional catch up contribution of 6500. For those age 50 or over who are making catch-up contributions the limits are 26000 in 2020 an additional 6500.

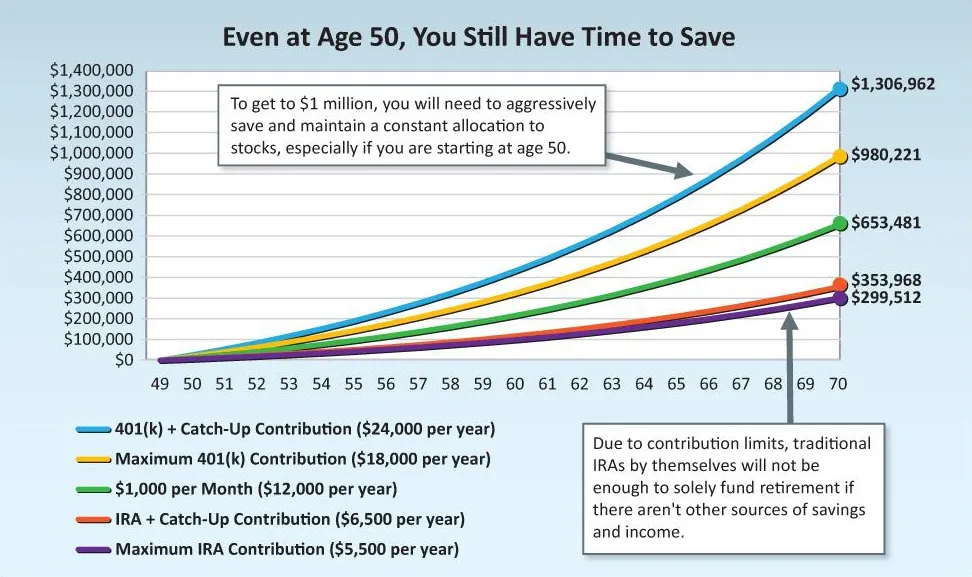

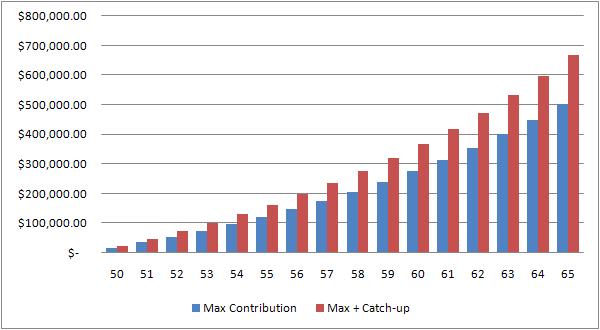

A 401 k can be one of your best tools for creating a secure retirement. The maximum catch-up contribution available is 6500 for 2022. If you are 50 or older you can make an additional 401 k contribution of 6500 a year.

Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. Ad A Rule of Thumb Is That Youll Need 10 Times Your Income at Retirement. In 2019 the additional annual contribution limit for 401k 403b most 457 plans and the federal governments Thrift Savings Plan will stay the same for employees age 50 or.

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. The IRA catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains 1000. A Retirement Calculator To Help You Plan For The Future.

Individuals who are age 50 or over at the end of the calendar year can make annual catch-up contributions. We show you top results so you can stop searching and start finding the answers you need. Reviews Trusted by Over 45000000.

The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. The catch-up contribution limit is 6500 in 2022 for people age 50 or older. That could really accelerate.

First all contributions and earnings to your 401 k are tax deferred. Annual catch-up contributions up to 6500 in 2022 6500 in 2021. There was a change in regulation in 1978 that affects retirement plans.

Ad TIAA IRAs Can Give You The Flexibility And Convenience You May Need. It provides you with two important advantages. What is a 401k.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. 1 This is known as a catch-up contribution and it applies from the start of the year to. The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older.

If you are 50 years of age or older and are already contributing the maximum amount permitted by your plan you can contribute up to an additional 6000 annually. Those turning 50 or older can put a. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

The catch-up contribution limit for. The annual elective deferral limit for a 401k plan in 2022 is 20500.

27 Retirement Savings Catch Up Strategies For Late Starters

Simple Retirement Savings Calculator Easy To Use Retirement Savings Calculator Savings Calculator Saving For Retirement

After Tax 401 K Contributions Retirement Benefits Fidelity

A Comprehensive Analysis Of 401k Catch Up Contributions Wealth Nation

How To Catch Up In Your Retirement Savings Plans Equitable

Best Retirement Calculator Retirement Calculator Retirement Income Saving For Retirement

Advice And Tips On Saving For Retirement At Any Age Marketplace Org Money Saving Tips Budgeting Money Money Management

401k Calculator

How To Play Catch Up With Your Retirement Savings Barron S

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

Resources To Help You Manage Your 401k Independent 401k Advisors

How Much Should I Have In My 401 K At 50

How Do Structured Settlement Annuities Work Lifehealthpro Annuity Structured Settlements Budgeting Money

Retirement You Can Save 1 Million Even Starting At Age 50 Money

15 Strategies For Quickly Expanding Your Business Growing Your Business Business Personal Finance

401k Catch Up Contributions Retirement Catch Up Limits

With Age Comes Great Responsibilities And At The Top Of Your List Should Be Taking Charge Of Your Money Www Levo Com Finance Personal Finance Budgeting Money